Recently, North American graphite miners have petitioned the U.S. government to impose tariffs of up to 920% on battery metals supplied by China. They claim that large-scale subsidies from China have led to low-price dumping, resulting in overcapacity, price disruptions, and impacts on domestic producers. This news has garnered significant attention in international trade and logistics circles, presenting new challenges and opportunities for the freight forwarding industry.

Graphite, a critical material for EV batteries and various high-tech products, is of immense importance. Data shows that in 2023, China accounted for 77% of U.S. graphite imports and controlled over 90% of the global supply of high-quality graphite, making it the dominant player in the global graphite supply chain.

However, U.S. graphite producers argue that the existing 25% tariff is insufficient to counter China's "low-price dumping." They are urging the U.S. Department of Commerce and International Trade Commission (ITC) to investigate. If unfair trade practices are confirmed, the U.S. may impose anti-dumping tariffs as high as 920%, with preliminary duties potentially taking effect during the investigation.

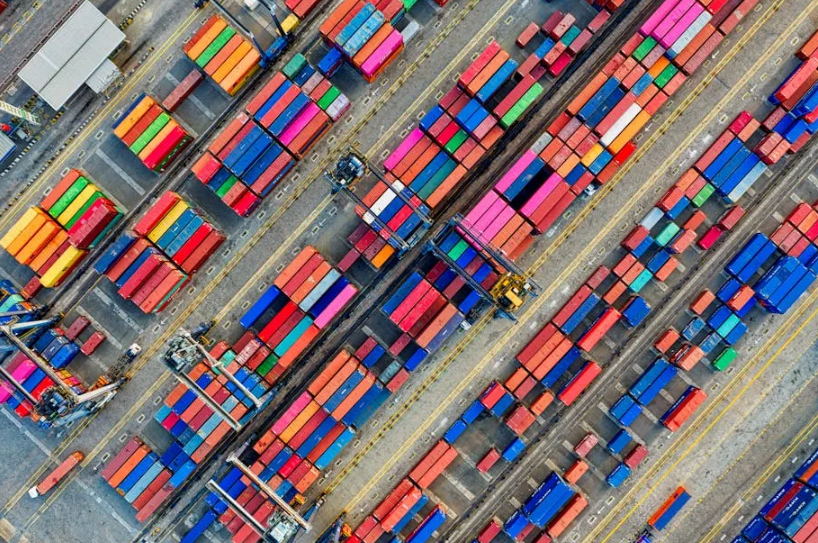

Should the U.S. proceed with such steep tariffs on Chinese graphite, the freight forwarding and logistics sector will face significant impacts. First, the high tariffs will drive up transportation costs, affecting the efficiency and expenses of the entire supply chain. Second, the uncertainty of trade disputes may increase transportation risks, posing more challenges for freight forwarders in planning and executing logistics solutions.

Last

Southeast Asian shipping giant announces job cuts!

Pacific International Lines (PIL), Southeast Asia's largest shipping company, has announced job cuts as the company is pushing for

Next

A $1,000 Increase Per Container! More Rate Hikes May Arrive in January

Driven by a series of GRI rate increases in mid-December, trans-Pacific container spot rates surged significantly this week.Follow