Driven by a series of GRI rate increases in mid-December, trans-Pacific container spot rates surged significantly this week.

Following a 26% week-on-week increase in the Drewry World Container Index, shippers on the eastbound trans-Pacific route from Asia to the U.S. West Coast found themselves paying nearly $1,000 more per 40-foot container (FEU).

The WCI Shanghai-Los Angeles route rose by $913 per container this week, closing at $4,499/FEU.

Shippers to the U.S. East Coast and Gulf Coast also faced similar price hikes, with the WCI Shanghai-New York route climbing 17% last week, closing at $6,074/FEU.

While the Shanghai-New York rates saw a modest increase last week, this week's uptick in Shanghai-Los Angeles rates marked the first significant rise in weeks.

Meanwhile, Xeneta's XSI short-term index tracking these two trans-Pacific routes recorded a 10% weekly increase, reaching $4,391/FEU.

January GRI Increases and Additional Planned Surcharges May Trigger Further Spot Rate Surges

Analysts noted:

"Drewry expects trans-Pacific trade rates to rise further in the coming week due to the impending ILA port strike in January and anticipated tariff hikes following the Trump administration's inauguration."

Sources indicate that many trans-Pacific carriers have filed GRIs with the FMC for January 1. COSCO, Evergreen, Hapag-Lloyd, HMM, and YML are targeting $3,000/FEU, CMA CGM and ZIM plan to impose $2,000/FEU, while ONE is aiming for $1,000/FEU.

Meanwhile, trans-Atlantic spot rates are also climbing. The WCI Rotterdam-New York route increased by 3% last week, closing at $2,713/FEU, an 83% year-on-year rise. Xeneta’s trans-Atlantic index similarly rose 3% weekly, reaching $2,814/FEU.

MSC recently announced it would increase EOS from Northern Europe to the U.S. from the planned $1,000/FEU to $2,500/FEU starting January 18. If other carriers follow MSC's lead, trans-Atlantic spot rates may climb further next month.

"With trans-Atlantic route networks set for service restructuring in 2025, operational disruptions are expected in the early months of next year," analysts added. MSC’s EOS increase, effective January 18 until further notice, coincides with the January 15 ILA-USMX negotiation deadline, leaving trans-Atlantic shippers with significant variables to consider.

For Asia-Europe routes, this was a relatively calm week. WCI Shanghai-Rotterdam spot rates fell 1% to $4,819/FEU, reversing a minor rise last week due to global climate disruptions.

The WCI Shanghai-Genoa branch also dropped 2% to $5,424/FEU.

As is customary, most shippers and freight forwarders should have finalized annual rate negotiations with carriers on Asia-Europe routes by now. However, both carriers and 3PLs anticipate most agreements to be signed in the first quarter of next year.

Last

Up to 920%! U.S. Considers Tariffs on Chinese Graphite

Recently, North American graphite miners have petitioned the U.S. government to impose tariffs of up to 920% on battery metals sup

Next

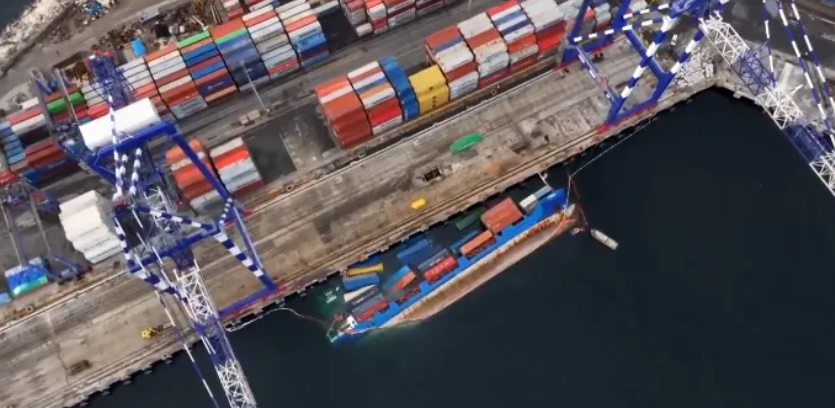

A Container Ship Overturned During Harbour Operations

On the morning of 23 December, a small container ship docked at the port of Ambali, Turkey's main container port in Istanbul, lost