With the deadline for the collective agreement between dockworkers at U.S. East Coast and Gulf Coast ports fast approaching, shipping companies have begun alerting customers to the volatile situation.

Maersk, Hapag-Lloyd, and CMA CGM Group have issued warnings to clients, describing the situation as "dynamic." With no signs of an agreement in sight, unions report being at an impasse, increasing the risk of disruption.

The United States Maritime Alliance (USMX) and the International Longshoremen's Association (ILA) previously ended an October 2024 strike by extending the contract deadline to January 15, 2025. As of this week, there are only four weeks left until the extended deadline and the potential January 16 shutdown.

In a December 20 advisory, Maersk stated, “The likelihood of a strike is increasing daily in the absence of an agreement.” The company noted it is awaiting further developments but highlighted that the holiday season adds complexity to the situation.

Similarly, Hapag-Lloyd issued a report echoing Maersk’s concerns, informing customers that "the risk of disruption is increasing," though acknowledging that the situation remains fluid. After exchanging blame for the stalemate last week, both the ILA and USMX have remained silent for several days.

The ILA continues to oppose semi-automation and appears emboldened by strong support from President-elect Donald Trump. His nominee for Labor Secretary, Oregon Representative Lori Chavez-DeRemer, is also considered a union advocate.

As the deadline looms, the American Chemistry Council (ACC) sent a letter on December 19 urging both sides to delay the deadline. They requested additional negotiation time, citing the January 29 start of the Lunar New Year, a period when much of Asia accelerates shipping before the holiday pause. Additionally, the ACC highlighted the January 20 U.S. Presidential Inauguration, noting that the transition requires time.

ACC President and CEO Eric Byer warned, “We fear that the dual challenges of the Presidential transition and Lunar New Year could cause irreparable harm to the U.S. economy and public if the contract lapses again.” He noted that October’s three-day strike caused weeks of supply chain disruptions and that even a few additional days of strikes could deplete members’ inventories of chemicals critical for processes like water treatment.

Port executives, particularly on the U.S. West Coast, have emphasized strong cargo volumes in November and are projecting robust levels through the end of 2024. They believe shippers are rerouting goods to the West Coast and front-loading shipments in preparation for a potential strike and possible tariff increases under the new administration.

Shipping companies are now advising clients to prepare for container removal. Maersk noted it remains unclear whether terminals will extend operating hours to support increased transport. Similarly, Hapag encouraged customers to expedite documentation and customs clearance to ensure timely container pickup. CMA CGM stated it is developing contingency plans to complete all affected vessel operations before any labor disruptions occur.

Traditionally, shipping lines have stationed vessels offshore during strikes, but experts caution that this could escalate into a prolonged dispute. Analysts suggest that with the incoming administration's backing and potential pressure from shippers, the unions could gain a stronger bargaining position in the final weeks before the contract deadline.

Last

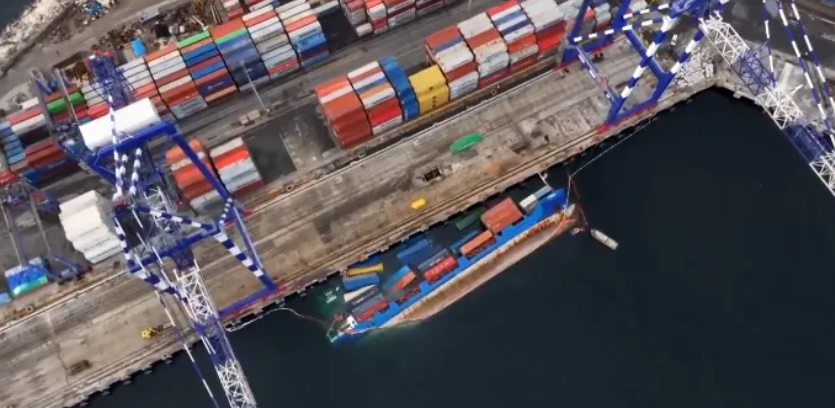

A Container Ship Overturned During Harbour Operations

On the morning of 23 December, a small container ship docked at the port of Ambali, Turkey's main container port in Istanbul, lost

Next

Busan Port to Trial "Smart Containers" to Prevent Lithium-Ion Battery Fires

Due to the fire risks posed by lithium-ion batteries, the Busan municipal government, in collaboration with South Korea's Ministry