Experts state that production bottlenecks for cargo aircraft make it difficult for airlines to meet shipping demand, which will limit growth in air cargo volumes next year.

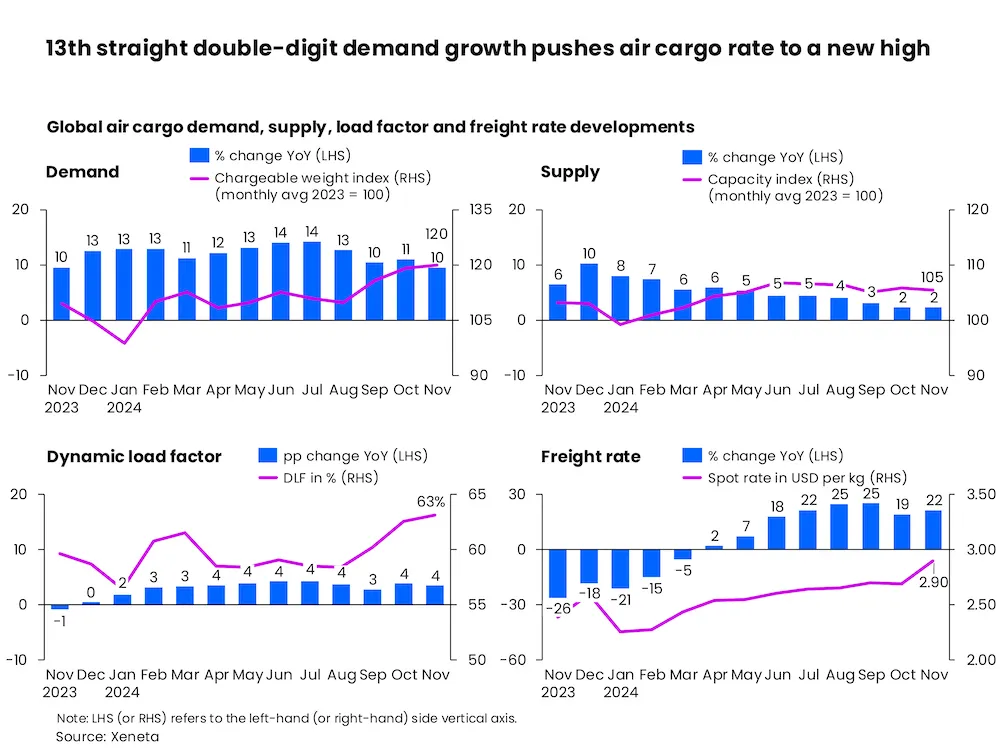

Some well-known industry figures warn that the air cargo growth rate in 2025 could halve—or even drop further—compared to this year’s peak levels. This prediction aligns with data showing continued momentum in air cargo demand in November, traditionally the busiest month of the year.

Expectations for air cargo growth in 2024 are around 1%-2%. After experiencing 12 consecutive months of double-digit growth and rising yields, many air logistics professionals had hoped for continued prosperity.

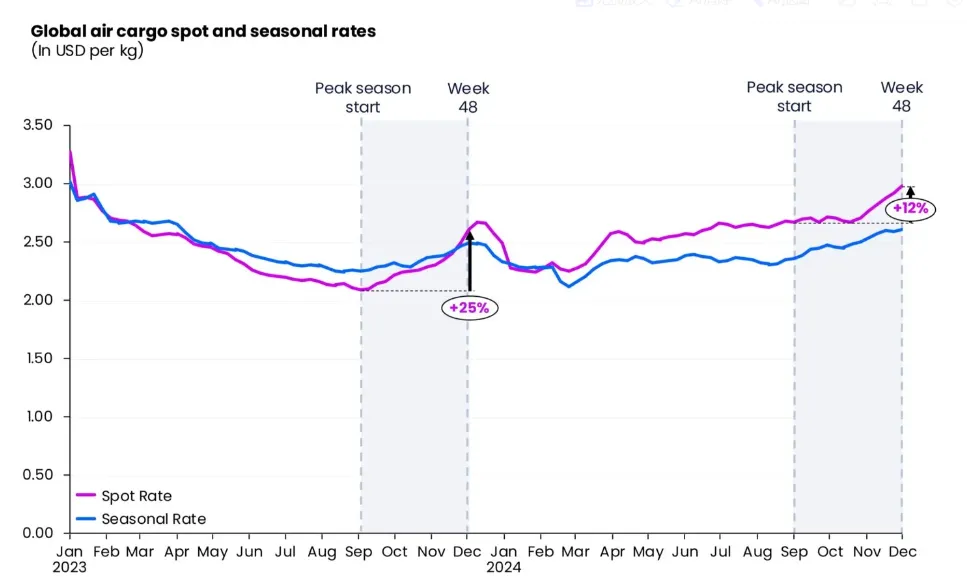

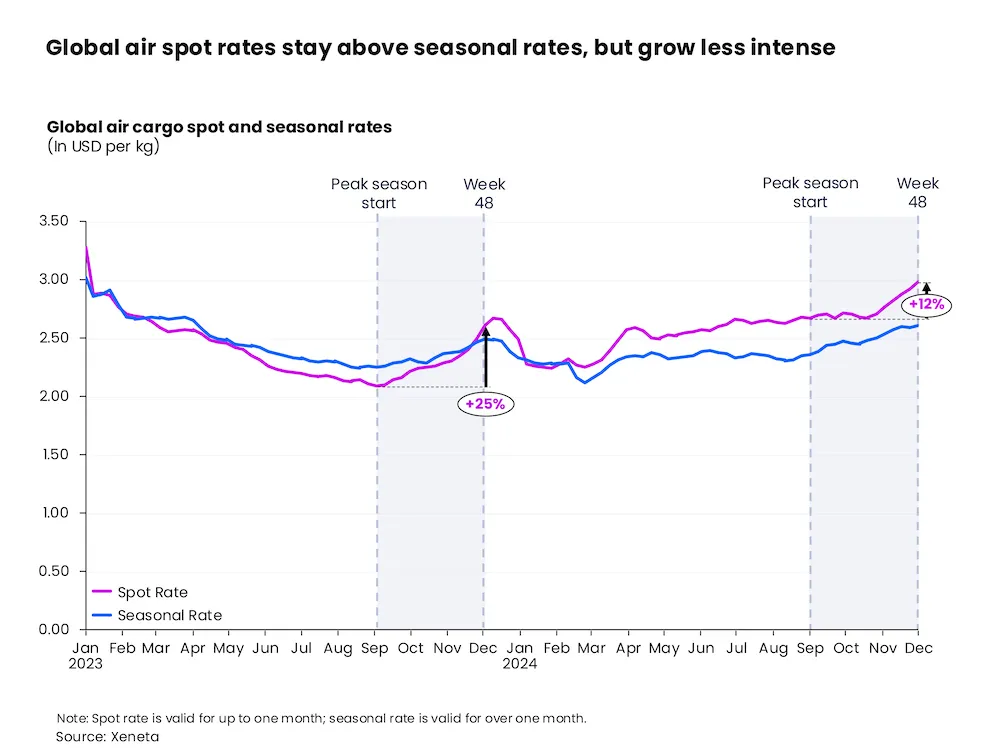

Cargo analytics firm Xeneta predicts air cargo demand to grow by 4%-6% next year, depending on trade lanes, while capacity is expected to grow by 4%-5%. According to Xeneta, November’s global short-term air freight rates reached a near two-year high of $2.90 per kilogram, marking the sixth consecutive month of double-digit year-on-year growth. Sustained supply-demand balance has pushed the load factor to 63%, the highest level in over 30 months. North America and Europe markets experienced the most pressure on rates as airlines adjusted cargo fleets to take advantage of high demand and yields in the Asia-Pacific region.

For most of the year, global air freight spot rates have been higher than contracted rates. According to WorldACD, westbound transatlantic rates increased 8% weekly, while eastbound transpacific rates to North America remained stable. Freightos reports that rates from China to North America dropped by 4% weekly to $6.62 per kilogram, while rates from China to Northern Europe dropped by 10%, driven by increased aircraft availability and businesses adjusting their shipping plans early.

WorldACD notes that transatlantic capacity declined by 3% annually over the past three weeks, with freighter capacity down 10%. Another reason for softer pricing trends in the Asia-Pacific region is that more forwarders secured bookings ahead of the peak season, reducing exposure to spot market fluctuations.

Last

Maersk Opens Its First Warehouse in France, Empowering Leading Global E-commerce Enterprises

With the inauguration of its new warehouse in Denain, northern France, Maersk has launched its first-ever warehouse in the country

Next

A New Chapter for Shipping Alliances! The Industry Faces a Shake-Up in 2025

Since April 2017, the global shipping industry has been profoundly influenced by the structure of the three major alliances: Ocean