Since April 2017, the global shipping industry has been profoundly influenced by the structure of the three major alliances: Ocean Alliance, THE Alliance, and 2M Alliance.

However, after nearly eight years of operation, this structure will undergo significant changes in February 2025. A new round of alliance arrangements is set to reshape the shipping industry. By then, the container shipping alliance ecosystem will include Gemini Cooperation (a collaboration between Maersk and Hapag-Lloyd), Premier Alliance (a partnership among HMM, ONE, and Yang Ming), and the Ocean Alliance (comprising CMA CGM, COSCO, Evergreen, and OOCL).

Changes in Market Share Among Shipping Alliances

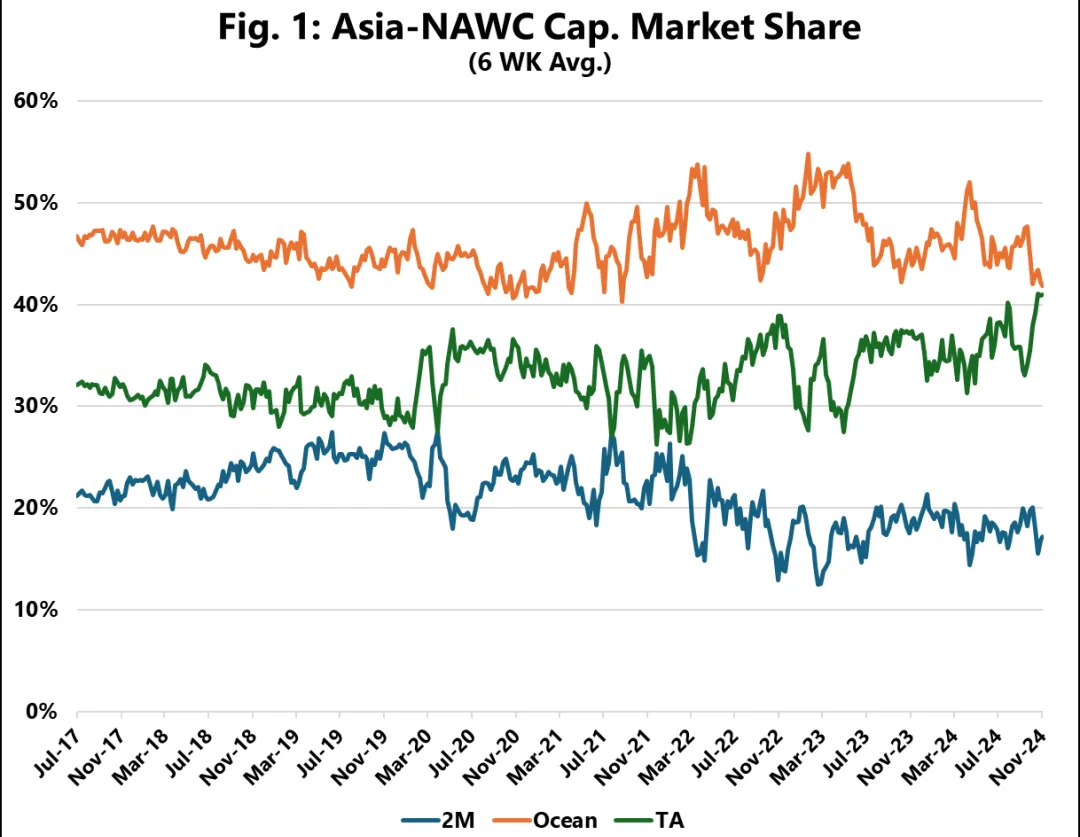

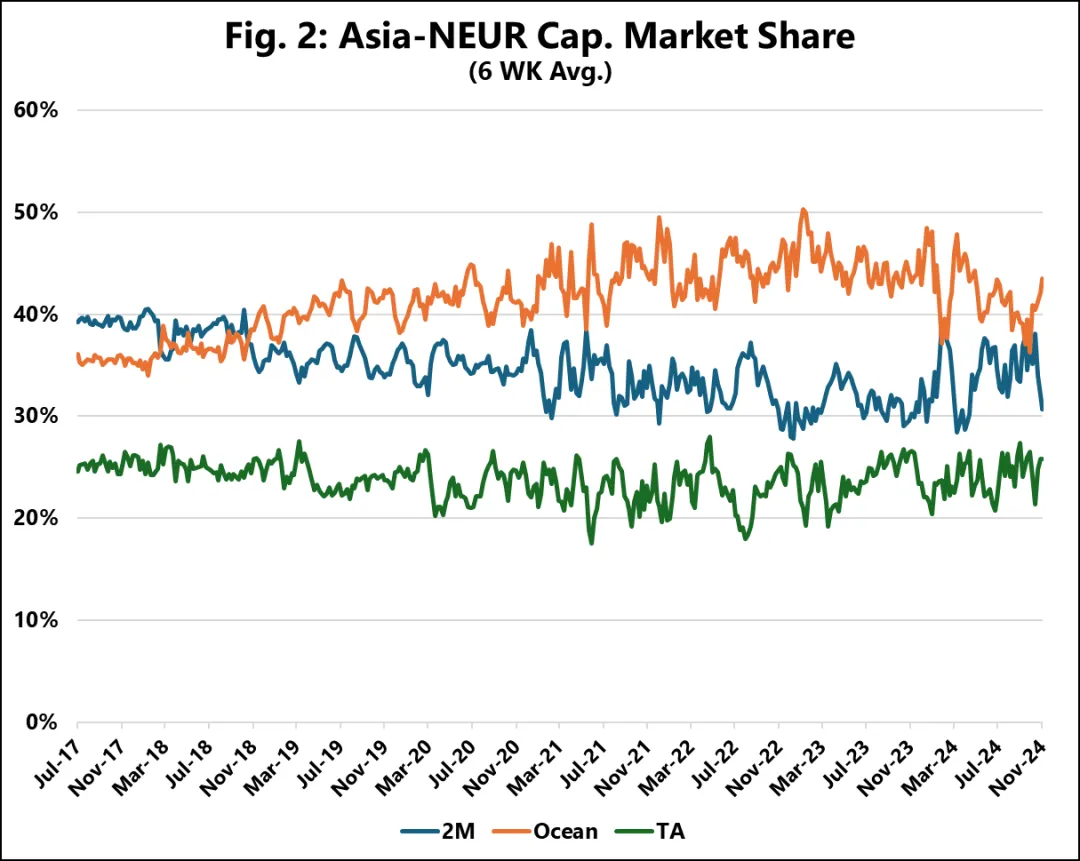

According to the CEO of Sea-Intelligence, capacity market share is a crucial indicator of a shipping alliance's influence on specific trade lanes. The following data highlights the current market share of the three alliances on the Asia–North America West Coast and Asia–Northern Europe trade lanes, providing an analysis of their market performance.

On the Asia–North America West Coast route, the Ocean Alliance has consistently dominated capacity deployment, while the 2M Alliance has maintained a lower market share. This dynamic has shown little fluctuation over the past few years, reflecting a stable market structure. Recently, however, THE Alliance has made notable progress, gradually narrowing the gap with the Ocean Alliance.

On the Asia–Northern Europe route, the Ocean Alliance surpassed the 2M Alliance in late 2018 and has since maintained its leading position in capacity market share. The 2M Alliance holds a steady second place, while THE Alliance, adopting a distinct market strategy from its counterparts, continues to operate with the smallest capacity share in the region.

With the introduction of the new alliance structure in February 2025, the trade dynamics of the shipping industry are expected to undergo significant transformation. Observers are keen to see how the strategic alignment of resources within each alliance will impact key trade routes and how alliances will concentrate their efforts in response to evolving market demands.

This new alliance framework is poised to fundamentally alter the market landscape on critical global trade routes, including those in the Asia-Pacific, North America, and Western Europe. It is anticipated to bring both fresh business opportunities and considerable challenges to the shipping industry.

Last

Air Cargo Growth Rate in 2025 May Halve

Experts state that production bottlenecks for cargo aircraft make it difficult for airlines to meet shipping demand, which will li

Next

Gemini Shipping Alliance Opens Bookings, Set to Launch in February 2025

The Gemini Cooperation, a new shipping alliance formed by Maersk and Hapag-Lloyd, has announced that it will begin accepting booki