The spot rates for container shipping remained relatively unchanged for the third consecutive week, as the rate adjustments on the Asia-Europe routes on November 15 had minimal impact on pricing.

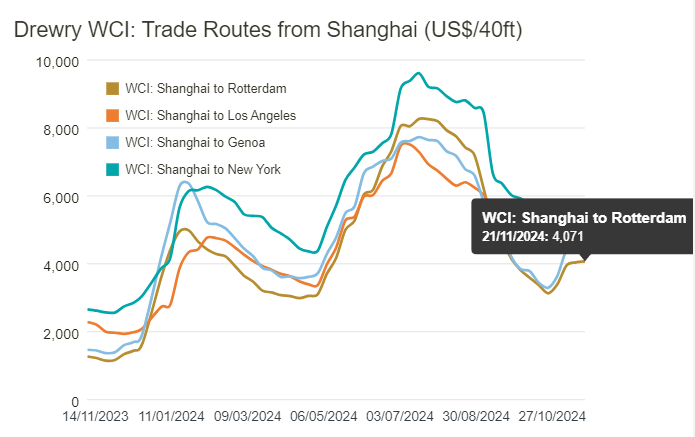

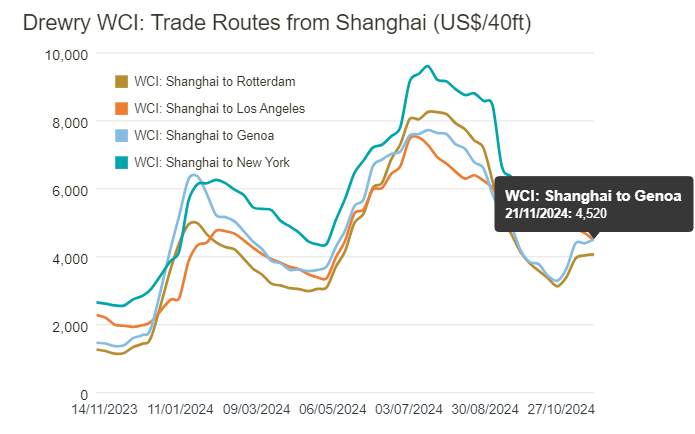

The Drewry World Container Index (WCI) reported a 1% decline in the global composite rate. However, rates from Shanghai to Rotterdam increased by 1% this week, reaching $4,071 per 40-foot container. Similarly, rates on the Shanghai to Genoa route rose by 3%, climbing to $4,520 per 40-foot container.

Although these rates are approximately 255% and 229% higher than the same period last year, freight forwarders across routes have noted that recent efforts by carriers to further increase spot rates have seen limited success. They remain skeptical about the impact of new FAK (Freight All Kinds) rates set to take effect on December 1.

An industry insider commented:

"Rates have been flat. We keep receiving notices of GRIs (General Rate Increases), but they dissipate quickly. We do not expect significant rate hikes in December."

Traditionally, the last two months of the year are a period for carriers and customers to finalize annual contract terms for Asia-Europe trade in the upcoming year, which are often influenced by spot rate trends. Industry players are now closely monitoring whether the FAK rate increases scheduled for December 1 will hold.

Recently, CMA CGM announced that FAK rates for Asia to West Mediterranean ports would be set at $6,500 per 40-foot container, matching earlier announcements by MSC. Hapag-Lloyd has also set rates of $6,100 to North Europe and $6,400 to the West Mediterranean, effective the same day.

Given that Asia-Europe spot rates would need to increase by 50% weekly to reach carrier expectations, the likelihood of these FAK rate hikes being fully realized appears slim.

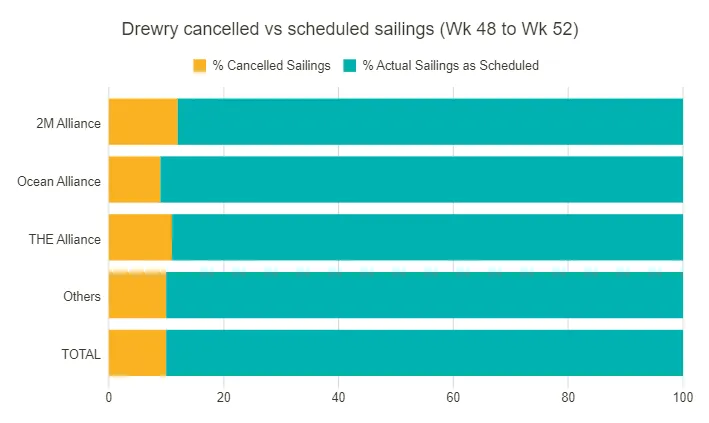

On the major East-West trade lanes—Trans-Pacific, Trans-Atlantic, Asia-North Europe, and Mediterranean—the cancellation rate for Weeks 48 (November 25 to December 1) and 52 (December 23 to December 29) stands at 10%. Most of these cancellations will occur on eastbound Trans-Pacific routes (50%), followed by westbound Trans-Atlantic routes (27%) and Asia-North Europe and Mediterranean routes (23%).

Over the next five weeks, THE Alliance, OCEAN Alliance, and 2M are expected to cancel 14 sailings each, while non-alliance services have announced 28 cancellations during the same period.

Advisory firms have warned shippers and freight forwarders to brace for additional sailing cancellations, which could further impact schedule reliability.

Last

200% surge shocks the market! Spot freight rates on China-Mexico trade route hit a record high

According to Xeneta data, the China-Mexico trade route experienced an 18.9% year-on-year increase in volume during the first nine

Next

MSC Receives Full Regulatory Approval for Participation in HHLA

MSC Completes Acquisition of 49.9% Stake in HHLA with Full Regulatory ApprovalOn November 14, Mediterranean Shipping Company (MSC)