DDU/DDP are well-known trade terms, and "anti-dumping duty" has become a frequent term in recent years of trade. Today, we share a real case to discuss these two "hot topics."

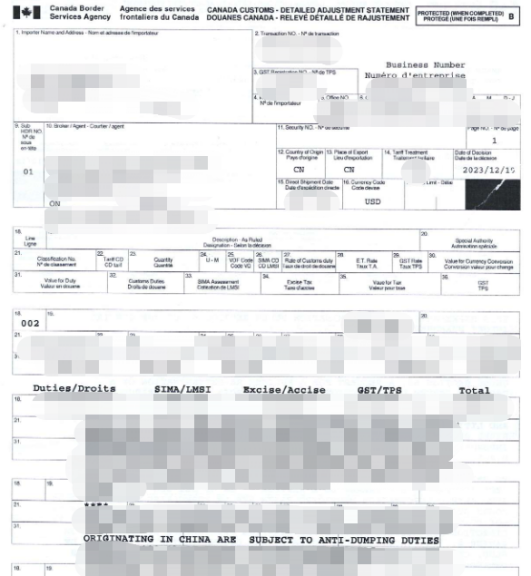

In 2023, a Canadian member filed a complaint against a Chinese member for unpaid fees. When the platform intervened, it was discovered that there was a dispute between both parties regarding the payment. The dispute involved "anti-dumping duty" and the special collection cycle of this tax (3-5 years), which carries significant uncertainty. The Canadian member insisted that the "shipper" should bear the cost, while the Chinese member, citing DDU terms, classified the "anti-dumping duty" as "import tax" and insisted that the "receiver" should bear the cost. Unable to reach an agreement, both parties applied for "dispute resolution" on the platform, hoping for mediation to handle the dispute.

There is a clear legal explanation for "anti-dumping duty," which must be followed by all taxpayers as it is an effective measure against dumping imported products, ensuring the value of similar domestic products is maintained or improved. During the collection process, no appeals or other forms of relief are allowed. However, when such issues arise in real trade scenarios, they lead to a series of chain reactions. For example, during the platform's processing, both members provided relevant evidence to demonstrate the tax's impact on them and the additional economic losses incurred. Therefore, the platform could only suggest that both members negotiate and seek a solution through mutual agreement.

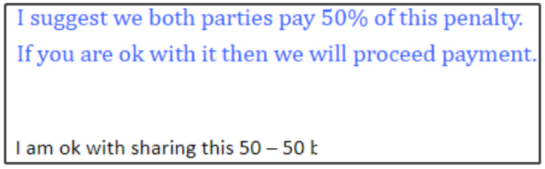

After nearly a week of coordination, an agreement was reached to share the cost.

Although the dispute was resolved, the issues in this case remind all freight forwarding experts to avoid such situations in our business processes.

Under DDU operations, the import taxes in the importing country need to be borne by the receiver.

"Anti-dumping duty" may cause disputes in actual business. If this tax is involved, both parties should be informed promptly and confirm who will bear the cost.

Finally, any international logistics cooperation requires cooperation and understanding from both parties. When disputes arise, they can be resolved through negotiation. We hope all freight forwarding experts can use the JCTRANS platform to connect with more partners, expand business areas, and achieve mutual benefits.

JCtrans.com

Last

"Under-Reporting of Goods Value" Leads to Customs Seizure and Fines, Yet the Blame is Shifted! JCtrans Restores the Truth for Customers.

In international logistics, freight forwarders, actingas agents for factories/traders, must meticulously verify cargo information

Next

Cargo Intercepted and Destroyed by Customs at a Third Country Transit Point

In an air shipment from the United States to India, when the cargo arrived at the transit port, the transit port customs discovere